By Kevin L. Licensed Insurance Producer

——

Attending a US college can be financially stressful. The average fee to attend a private non-profit four-year university is $48,510 per year. For international students, the costs are even higher.

But do you know that you can save up to $2098 a year with insurance waiver?

What is an insurance waiver?

On your tuition bill, you will see that UNCC has automatically enrolled you in the university’s insurance plan.

However, international students can enroll in a surprisingly more affordable plan designed specifically for them. UNCC Student Blue Plan costs $2,627 a year. Alternatively, health coverage for international students can be as low as $529 a year.

An insurance waiver is an application to switch your plan that better fits your needs. Simply enroll in an insurance plan that meets the school’s waiver requirements and submit an insurance waiver on the school’s website.

Why are health insurances plans more affordable?

The insurance costs are calculated based on the risks of the demographics. University health plans are usually more expensive because the plans serve a broader range of the population, including international and domestic students.

How to pick a health insurance plan?

A good insurance plan protects you from minor illnesses to serious injuries and diseases. When you’re looking for a plan, consider these factors:

Can you recommend a good health insurance plan?

Student Medicover, a partner of UnitedHealthcare, offers the most cost-effective and reliable health insurance plans for international students in the market.

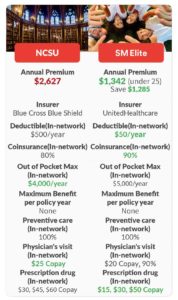

Here is a brief comparison between UNCC Student Blue Plan and Student Medicover’s plans:

The chart is only a brief overview. Please refer to the policy brochures to learn more about the plans.

How to waive health insurance?

Completing an insurance waiver is very simple. It takes you only 15 minutes.

After your application is approved, the school will either refund you or remove the health insurance fee on your tuition bill.

If you need any help, you can always reach out to Student Medicover’s customer service team:

Facebook: @smcovered https://www.facebook.com/smcovered

Email: sm@smcovered.com

24/7 Tel: 812-360-2313

WhatAspp: 1-812-360-2313

About Student Medicover

By partnering with UnitedHealthcare, Student Medicover provides cost-effective, comprehensive insurance plans. We’re a team of experienced health enthusiasts who serve students with compassion, professionalism, and dedication.

Founded in 2013, Student Medicover maintained an annual sales growth of more than 200% and now serves more than 20,000 international students from 43 countries and 662 universities. We partnered with more than 120 student organizations across the country in order to build a supportive, vibrant, and healthy community.

“International students in the U.S usually lack minimum education in healthcare. The problem threatens to undermine students’ health. Besides, international students are reluctant to seek necessary treatment, for fear of long wait times and steep bills.

Student Medicover strives to make high-quality, affordable healthcare accessible to every international student. ”

——Jerry Hu, CEO of Student Medicover

Reference:

–https://www.thebalance.com/health-insurance-waiver-2645762

–https://www.internationalstudent.com/study_usa/preparation/health-care/

https://smcovered.com/visit-a-doctor/find-a-doctor/

Link: https://smcovered.com/enrollment/review-certificates-flyers/

By Kevin L. Licensed Insurance Producer

——

Attending a US college can be financially stressful. The average fee to attend a private non-profit four-year university is $48,510 per year. For international students, the costs are even higher.

But do you know that you can save up to $2,266 a year with insurance waiver?

What is an insurance waiver?

On your tuition bill, you will see that UConn has automatically enrolled you in the university’s Student Health Insurance.

However, international students can enroll in a surprisingly more affordable plan designed specifically for them. The School Health Insurance Plan of UConn costs $2,795 a year. Alternatively, health coverage for international students can be as low as $529 a year.

An insurance waiver is an application to switch your plan that better fits your needs. Simply enroll in an insurance plan that meets the school’s waiver requirements and submit an insurance waiver on the school’s website.

Why are health insurances plans more affordable?

The insurance costs are calculated based on the risks of the demographics. University health plans are usually more expensive because the plans serve a broader range of the population, including international and domestic students.

How to pick a health insurance plan?

A good insurance plan protects you from minor illnesses to serious injuries and diseases. When you’re looking for a plan, consider these factors:

Can you recommend a good health insurance plan?

Student Medicover, a partner of UnitedHealthcare, offers the most cost-effective and reliable health insurance plans for international students in the market.

Here is a brief comparison between UConn SHIP and Student Medicover’s plans:

The chart is only a brief overview. Please refer to the policy brochures to learn more about the plans.

How to waive health insurance?

Completing an insurance waiver is very simple. It takes you only 15 minutes.

Click: Main Menu–> Self Service –>Student Center –>Permissions & Requests–>Health Insurance Waiver;

Fill in the form with your personal information, insurance information and click “Submit”.

After your application is approved, the school will either refund you or remove the health insurance fee on your tuition bill.

After your application is approved, the school will either refund you or remove the health insurance fee on your tuition bill.

If you need any help, you can always reach out to Student Medicover’s customer service team:

Facebook: @smcovered https://www.facebook.com/smcovered

Email: sm@smcovered.com

24/7 Tel: 812-360-2313

WhatAspp: 1-812-360-2313

About Student Medicover

By partnering with UnitedHealthcare, Student Medicover provides cost-effective, comprehensive insurance plans. We’re a team of experienced health enthusiasts who serve students with compassion, professionalism, and dedication.

Founded in 2013, Student Medicover maintained an annual sales growth of more than 200% and now serves more than 20,000 international students from 43 countries and 662 universities. We partnered with more than 120 student organizations across the country in order to build a supportive, vibrant, and healthy community.

“International students in the U.S usually lack minimum education in healthcare. The problem threatens to undermine students’ health. Besides, international students are reluctant to seek necessary treatment, for fear of long wait times and steep bills.

Student Medicover strives to make high-quality, affordable healthcare accessible to every international student. ”

——Jerry Hu, CEO of Student Medicover

Reference:

–https://www.thebalance.com/health-insurance-waiver-2645762

–https://www.internationalstudent.com/study_usa/preparation/health-care/

https://smcovered.com/visit-a-doctor/find-a-doctor/

Link: https://smcovered.com/enrollment/review-certificates-flyers/

By Kevin L. Licensed Insurance Producer

——

Attending a US college can be financially stressful. The average fee to attend a private non-profit four-year university is $48,510 per year. For international students, the costs are even higher.

But do you know that you can save up to $4,061 a year with insurance waiver?

What is an insurance waiver?

On your tuition bill, you will see that Stanford has automatically enrolled you in the university’s Student Health Insurance.

However, international students can enroll in a surprisingly more affordable plan designed specifically for them. The Cardinal Care of Stanford University costs $5,208 a year. Alternatively, health coverage for international students can be as low as $1,147 a year.

An insurance waiver is an application to switch your plan that better fits your needs. Simply enroll in an insurance plan that meets the school’s waiver requirements and submit an insurance waiver on the school’s website.

Why are health insurances plans more affordable?

The insurance costs are calculated based on the risks of the demographics. University health plans are usually more expensive because the plans serve a broader range of the population, including international and domestic students.

How to pick a health insurance plan?

A good insurance plan protects you from minor illnesses to serious injuries and diseases. When you’re looking for a plan, consider these factors:

Can you recommend a good health insurance plan?

Student Medicover, a partner of UnitedHealthcare, offers the most cost-effective and reliable health insurance plans for international students in the market.

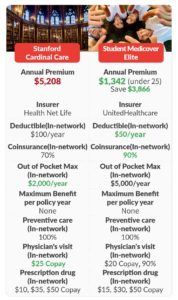

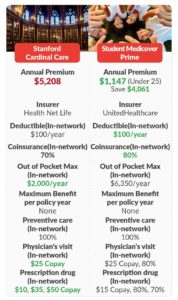

Here is a brief comparison between Cardinal Care and Student Medicover’s plans:

The chart is only a brief overview. Please refer to the policy brochures to learn more about the plans.

How to waive health insurance?

Completing an insurance waiver is very simple. It takes you only 15 minutes.

After your application is approved, the school will either refund you or remove the health insurance fee on your tuition bill.

If you need any help, you can always reach out to Student Medicover’s customer service team:

Facebook: @smcovered https://www.facebook.com/smcovered

Email: sm@smcovered.com

24/7 Tel: 812-360-2313

WhatAspp: 1-812-360-2313

About Student Medicover

By partnering with UnitedHealthcare, Student Medicover provides cost-effective, comprehensive insurance plans. We’re a team of experienced health enthusiasts who serve students with compassion, professionalism, and dedication.

Founded in 2013, Student Medicover maintained an annual sales growth of more than 200% and now serves more than 20,000 international students from 43 countries and 662 universities. We partnered with more than 120 student organizations across the country in order to build a supportive, vibrant, and healthy community.

“International students in the U.S usually lack minimum education in healthcare. The problem threatens to undermine students’ health. Besides, international students are reluctant to seek necessary treatment, for fear of long wait times and steep bills.

Student Medicover strives to make high-quality, affordable healthcare accessible to every international student. ”

——Jerry Hu, CEO of Student Medicover

Reference:

–https://www.thebalance.com/health-insurance-waiver-2645762

–https://www.internationalstudent.com/study_usa/preparation/health-care/

https://smcovered.com/visit-a-doctor/find-a-doctor/

Link: https://smcovered.com/enrollment/review-certificates-flyers/

https://vaden.stanford.edu/sites/g/files/sbiybj10461/f/insurance-coverage-certification_fy18_0.pdf

By Kevin L. Licensed Insurance Producer

——

Attending a US college can be financially stressful. The average fee to attend a private non-profit four-year university is $48,510 per year. For international students, the costs are even higher.

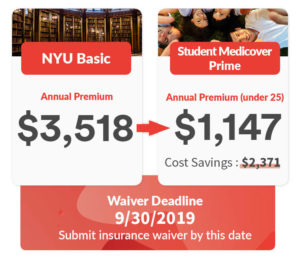

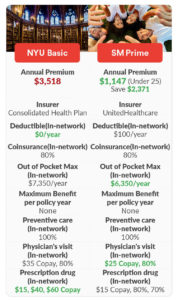

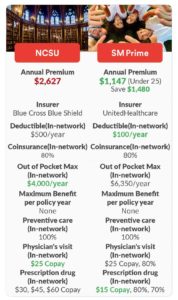

But do you know that you can save up to $2,371 a year with insurance waiver?

What is an insurance waiver?

On your tuition bill, you will see that NYU has automatically enrolled you in the university’s Student Health Insurance.

However, international students can enroll in a surprisingly more affordable plan designed specifically for them. The Basic Plan of New York University costs $3,518 a year. Alternatively, health coverage for international students can be as low as $1,147 a year.

An insurance waiver is an application to switch your plan that better fits your needs. Simply enroll in an insurance plan that meets the school’s waiver requirements and submit an insurance waiver on the school’s website.

Why are health insurances plans more affordable?

The insurance costs are calculated based on the risks of the demographics. University health plans are usually more expensive because the plans serve a broader range of the population, including international and domestic students.

How to pick a health insurance plan?

A good insurance plan protects you from minor illnesses to serious injuries and diseases. When you’re looking for a plan, consider these factors:

Can you recommend a good health insurance plan?

Student Medicover, a partner of UnitedHealthcare, offers the most cost-effective and reliable health insurance plans for international students in the market.

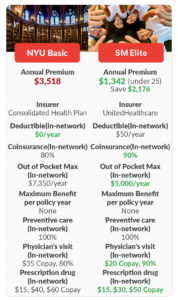

Here is a brief comparison between NYU Basic and Student Medicover’s plans:

The chart is only a brief overview. Please refer to the policy brochures to learn more about the plans.

How to waive health insurance?

Completing an insurance waiver is very simple. It takes you only 15 minutes.

To download the card, simply register a UHCSR account by visiting uhcsr.com and clicking Create My Account at the bottom.

Email or mail the waiver form to school insurance office and submit waive request on school insurance website: https://nyu.consolidatedhealthplan.com/student_health/new_york_university/initial_login.html

After your application is approved, the school will either refund you or remove the health insurance fee on your tuition bill.

If you need any help, you can always reach out to Student Medicover’s customer service team:

Facebook: @smcovered https://www.facebook.com/smcovered

Email: sm@smcovered.com

24/7 Tel: 812-360-2313

WhatAspp: 1-812-360-2313

About Student Medicover

By partnering with UnitedHealthcare, Student Medicover provides cost-effective, comprehensive insurance plans. We’re a team of experienced health enthusiasts who serve students with compassion, professionalism, and dedication.

Founded in 2013, Student Medicover maintained an annual sales growth of more than 200% and now serves more than 20,000 international students from 43 countries and 662 universities. We partnered with more than 120 student organizations across the country in order to build a supportive, vibrant, and healthy community.

“International students in the U.S usually lack minimum education in healthcare. The problem threatens to undermine students’ health. Besides, international students are reluctant to seek necessary treatment, for fear of long wait times and steep bills.

Student Medicover strives to make high-quality, affordable healthcare accessible to every international student. ”

——Jerry Hu, CEO of Student Medicover

Reference:

–https://www.thebalance.com/health-insurance-waiver-2645762

–https://www.internationalstudent.com/study_usa/preparation/health-care/

https://smcovered.com/visit-a-doctor/find-a-doctor/

Link: https://smcovered.com/enrollment/review-certificates-flyers/

By Kevin L. Licensed Insurance Producer

——

Attending a US college can be financially stressful. The average fee to attend a private non-profit four-year university is $48,510 per year. For international students, the costs are even higher.

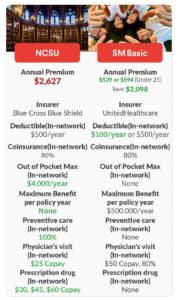

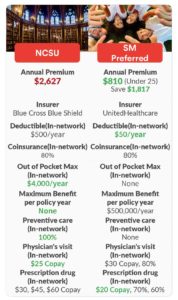

But you can save up to $2098 a year with insurance waiver.

What is an insurance waiver?

On your tuition bill, you will see that NCSU has automatically enrolled you in the university’s Student Health Insurance, which costs $2,627 a year.

However, international students can enroll in a surprisingly affordable plan designed specifically for them. NCSU Student Health Insurance costs $2,627 a year. Alternatively, health coverage for international students can be as low as $529 a year.

An insurance waiver is an application to switch your plan that better fits your needs. Simply enroll in an insurance plan that meets the school’s waiver requirements and submit an insurance waiver on the school’s website.

Why are health insurances plans more affordable?

The insurance costs are calculated based on the risks of the demographics. University health plans are usually more expensive because the plans serve a broader range of the population, including international and domestic students.

How to pick a health insurance plan?

A good insurance plan protects you from minor illnesses to serious injuries and diseases. When you’re looking for a plan, consider these factors:

Can you recommend a good health insurance plan?

Student Medicover, a partner of UnitedHealthcare, offers the most cost-effective and reliable health insurance plans for international students in the market.

Here is a brief comparison between NCSU’s Student Health Insurance and Student Medicover:

The chart is only a brief overview. Please refer to the policy brochures to learn more about the plans.

How to waive health insurance?

Completing an insurance waiver is very simple. It takes you only 15 minutes.

Visit Student Medicover’s website smcovered.com, scroll down to “Enrollment”, and enroll in Elite, Prime, Preferred, or Basic plan.

Wait for at least two business days for your ID card to be ready. Then register for an account and download the card on UHCSR, the insurance underwriter of Student Medicover.

Visit the website: https://studentbluenc.com/#/ncsu/waive, and fill out the waiver form with the information below:

Elite: 2019-203045-91

Prime: 2019-203113-91

Preferred: 2019-203044-91

Basic100: 2019-203043-91

Basic500: 2019-203043-93

Choose “Yes” of Waiver Agreements

Click “Submit”.

After your application is approved, the school will either refund you or remove the health insurance fee on your tuition bill.

If you need any help, you can always reach out to Student Medicover’s customer service team:

Facebook: @smcovered https://www.facebook.com/smcovered

Email: sm@smcovered.com

24/7 Tel: 812-360-2313

WhatAspp: 1-812-360-2313

About Student Medicover

By partnering with UnitedHealthcare, Student Medicover provides cost-effective, comprehensive insurance plans. We’re a team of experienced health enthusiasts who serve students with compassion, professionalism, and dedication.

Founded in 2013, Student Medicover maintained an annual sales growth of more than 200% and now serves more than 20,000 international students from 43 countries and 662 universities. We partnered with more than 120 student organizations across the country in order to build a supportive, vibrant, and healthy community.

“International students in the U.S usually lack minimum education in healthcare. The problem threatens to undermine students’ health. Besides, international students are reluctant to seek necessary treatment, for fear of long wait times and steep bills.

Student Medicover strives to make high-quality, affordable healthcare accessible to every international student. ”

——Jerry Hu, CEO of Student Medicover

Reference:

–https://www.thebalance.com/health-insurance-waiver-2645762

–https://www.internationalstudent.com/study_usa/preparation/health-care/

https://smcovered.com/visit-a-doctor/find-a-doctor/

Link: https://smcovered.com/enrollment/review-certificates-flyers/

By Kevin L. Licensed Insurance Producer

——

Attending a US college can be financially stressful. The average fee to attend a private non-profit four-year university is $48,510 per year. For international students, the costs are even higher.

But you can save up to $807 a year with insurance waiver.

What is an insurance waiver?

On your tuition bill, you will see that MSU has automatically enrolled you in the university’s Student Health Insurance, which costs $1,687 a year.

However, international students can enroll in a surprisingly affordable plan designed specifically for them. MSU Student Health Insurance costs $1,687 a year. Alternatively, health coverage for international students can be as low as $880 a year.

An insurance waiver is an application to switch your plan that better fits your needs. Simply enroll in an insurance plan that meets the school’s waiver requirements and submit an insurance waiver on the school’s website.

Why are health insurances plans more affordable?

The insurance costs are calculated based on the risks of the demographics. University health plans are usually more expensive because the plans serve a broader range of the population, including international and domestic students.

How to pick a health insurance plan?

A good insurance plan protects you from minor illnesses to serious injuries and diseases. When you’re looking for a plan, consider these factors:

Can you recommend a good health insurance plan?

Student Medicover, a partner of UnitedHealthcare, offers the most cost-effective and reliable health insurance plans for international students in the market.

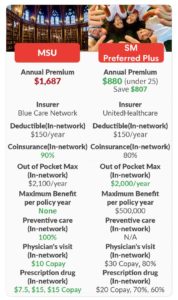

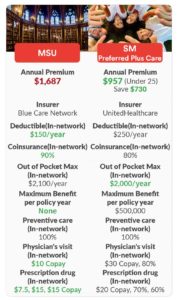

Here is a brief comparison between MSU’s Student Health Insurance and Student Medicover:

The chart is only a brief overview. Please refer to the policy brochures to learn more about the plans.

How to waive health insurance?

Completing an insurance waiver is very simple. It takes you only 15 minutes.

Visit Student Medicover’s website smcovered.com, scroll down to “Enrollment”, and enroll in either Preferred Plus plan or Preferred Plus Care plan.

Wait for at least two business days for your ID card to be ready. Then register for an account and download the card on UHCSR, the insurance underwriter of Student Medicover.

Visit MSU’s website: https://stuinfo.msu.edu/, and fill out the waiver form with the information below:

Choose “Yes” of QUESTIONS ABOUT YOUR COVERAGE.

Click “Continue”.

After your application is approved, the school will either refund you or remove the health insurance fee on your tuition bill.

If you need any help, you can always reach out to Student Medicover’s customer service team:

Facebook: @smcovered https://www.facebook.com/smcovered

Email: sm@smcovered.com

24/7 Tel: 812-360-2313

WhatAspp: 1-812-360-2313

About Student Medicover

By partnering with UnitedHealthcare, Student Medicover provides cost-effective, comprehensive insurance plans. We’re a team of experienced health enthusiasts who serve students with compassion, professionalism, and dedication.

Founded in 2013, Student Medicover maintained an annual sales growth of more than 200% and now serves more than 20,000 international students from 43 countries and 662 universities. We partnered with more than 120 student organizations across the country in order to build a supportive, vibrant, and healthy community.

“International students in the U.S usually lack minimum education in healthcare. The problem threatens to undermine students’ health. Besides, international students are reluctant to seek necessary treatment, for fear of long wait times and steep bills.

Student Medicover strives to make high-quality, affordable healthcare accessible to every international student. ”

——Jerry Hu, CEO of Student Medicover

Reference:

–https://www.thebalance.com/health-insurance-waiver-2645762

–https://www.internationalstudent.com/study_usa/preparation/health-care/

https://smcovered.com/visit-a-doctor/find-a-doctor/

Link: https://smcovered.com/enrollment/review-certificates-flyers/