America is the most popular destination for international students but the costs to attend a university can be frustrating. The average fee to attend a private non-profit four-year universities, including tuition and boarding expenses, is $48,510 per year. According to Statista, about 60% of international students are self-sponsored or supported by their families.

The high costs can lead to dire situations. The homelessness rate of universities has soared in the last decade. A fellow UC Berkeley student even lives in a small trailer with no heat or restroom.

Fortunately, we have many ways to save costs. A simple and fast solution is to switch your university health insurance to an affordable but still reliable, insurance plan. This process is called the insurance waiver.

What is an insurance waiver?

Most universities automatically enroll students in university health insurance plans, which cost $2000 per year on average. You can find the health insurance fee in your student account or the tuition bill. However, the university health insurance plan is not the only option. You can enroll in a marketplace health insurance and opt out of the plan provided by your university or college.

The cost savings of insurance waivers can be significant, sometimes even thousands of dollars a year. Health insurance plans offered by universities are usually more expensive because the costs are calculated according to the risks of a larger demographic.

Does UC Berkeley accept insurance waiver?

Yes. If you have adequate insurance coverage, which meets Berkeley’s requirements, you can submit an insurance waiver. The waiver period for UC Berkeley is May 1, 2019 to July 15, 2019. If you miss the deadline, you can submit your waiver between July 16, 2019 and August 15, 2019 with a late fee of $75. The school will not accept any applications after August 15, 2019.

How to choose marketplace insurance that’s right for me?

We understand that Medical services in America are expensive, you don’t want to enroll in a cheap insurance plan with limited protection and break your wallet for steep medical bills.

Here are a few tips to find a good insurance plan:

Compare costs –

Some plans are much more cost-effective than others. International student health insurance plans, such as Student Medicover, can save you thousands of dollars a year compared with the university health insurance. Schools’ plans are usually more expensive because they serve a broader range of population, including international and domestic students.

Review benefits –

Read the insurance policies carefully. A good insurance plan should have a low deductible, a high co-insurance, low copay, and a low out-of-pocket maximum.

Learn about the network –

A powerful insurance network and a group of care providers partnering with the insurance company allows you to find trustworthy doctors and hospitals wherever you need.

Can you recommend an affordable health insurance plan?

Currently, the most reliable and cost-efficient health insurance for international students is Student Medicover. They provide plans with low deductible, high co-insurance, low copay, and a low out-of-pocket maximum. Each plan is designed for international students based on their unique needs and experiences.

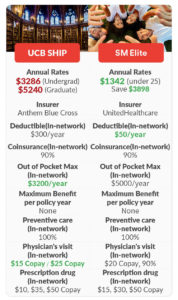

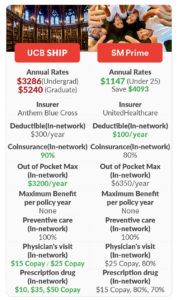

Here is a brief comparison :

Plans Highlights:

Unitedhealthcare Options PPO Network: PPO, one of the largest networks nationwide, is a group of health care providers that have a contract with United Healthcare. You can save money when you visit in-network providers.

Reliable Coverage: Protecting students is our priority. Our plans offer substantial coverage for doctor visits, hospital stays, emergency care, and prescription drugs.

Student Health Center: Our insurance can be used in any student health center in the U.S. including UCB university health services and Tang center.

How to waive health insurance?

Don’t panic, insurance waiver is not as complex as you think. Just go through the 3 steps listed below and you will enjoy your benefits with a much more reasonable price in only 15 minutes.

Visit Student Medicover website smcovered.com, click “Get A Quote“, and purchase prime or elite plan. Remember to download policy brochure for future waiver application.

To download the card, simply register a UHCSR account by visiting uhcsr.com and clicking Create My Account at the bottom.

To submit a waiver, please visit the university’s insurance waiver website at

https://studentinsurance.usi.com/UCB/UCB%20%20 and log in by your student account.

You can always reach out to the customer service team in the following ways:

Facebook: @smcovered https://www.facebook.com/smcovered

Email: sm@smcovered.com

Tel: 812-360-2313 (24/7)

About Student Medicover

By partnering with UnitedHealthcare, Student Medicover provide cost-effective, comprehensive insurance plans. We’re a team of experienced health enthusiasts who serve students with compassion, professionalism, and dedication.

Founded in 2013, Student Medicover maintained an annual sales growth of more than 200% and now serves more than 20,000 international students from 43 countries and 662 universities. We partnered with more than 120 student organizations across the country in order to build supportive, vibrant, and healthy communities.

“International students in the U.S usually lack minimum education in healthcare. The problem threatens to undermine students’ health. Besides, international students are reluctant to seek necessary treatment, for fear of long wait times and steep bills.

Student Medicover strives to make high-quality, affordable healthcare accessible to every international student. “

——Jerry Hu, CEO of Student Medicover

Reference:

–https://www.thebalance.com/health-insurance-waiver-2645762

–https://uhs.berkeley.edu/insurance/waiving-ship

–https://www.internationalstudent.com/study_usa/preparation/health-care/